Become a Patreon!

Abstract

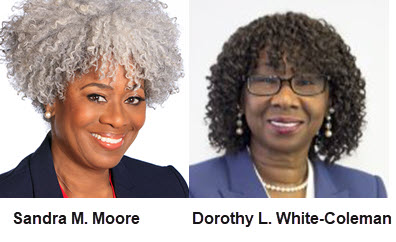

Excerpted From: Sandra M. Moore and Dorothy L. White-Coleman, The Role of Law, Policy, and Practice in the Erosion of Economic Power in Underserved Communities, 67 Washington University Journal of Law & Policy 243 (2022) (177 Footnotes) (Full Document)

As we stand at the eclipse of the 100th anniversary of the founding of the Mound City Bar Association, we find ourselves in the shadow of some of the most turbulent civil and social times seen in recent American history: a pandemic, civil unrest, renewed racial strife, and revived racial awareness or first time, novice racial sensitivity. Amongst it all, there are economic overtones and undercurrents. This Article seeks to explore pieces of societal infrastructure that have failed to provide the financial floor that African Americans need to stand on to maximize economic power, prowess, and potential. We will examine the disparity in access to capital and business opportunity, which is a disparity wrapped in the tangled web of law, policy, and practice.

As we stand at the eclipse of the 100th anniversary of the founding of the Mound City Bar Association, we find ourselves in the shadow of some of the most turbulent civil and social times seen in recent American history: a pandemic, civil unrest, renewed racial strife, and revived racial awareness or first time, novice racial sensitivity. Amongst it all, there are economic overtones and undercurrents. This Article seeks to explore pieces of societal infrastructure that have failed to provide the financial floor that African Americans need to stand on to maximize economic power, prowess, and potential. We will examine the disparity in access to capital and business opportunity, which is a disparity wrapped in the tangled web of law, policy, and practice.

It is oftentimes unclear which is the constraining factor: law, policy, or practice. It is exceedingly clear that the effect of the disparate treatment is intricately braided into all three. Volumes have been written regarding disparity in economic opportunity for African Americans, so we have narrowed our focus here to two discrete areas for exploration: financing minority businesses and minority business growth. This focus provides the cornerstone of our organizing thesis: the erosion of economic power in underserved communities is locked up in the dearth of business growth and development in those same communities.

For this Article, “underserved” is a euphemism for predominantly African American and Latinx communities. We assert here that the growth of businesses owned and operated by black and brown people in, around, or connected to the communities where they live is a cornerstone to economic power for these communities--our communities. So in this Article we look at key, law, policy, and practice barriers to that growth, barriers that both deny growth and erode that which happens to break through.

We note that much has been written in this area over the years, from the ample writings about the challenges of the Small Business Administration's (“SBA”) efforts to “support” minority businesses, to the recent rash of articles on disparity in the Payroll Protection Program (“PPP”) recipients. We will draw and rely on earlier scholarly works about disparate economic opportunity rooted in the law. However, we write as an African American lawyer investor and as an African American lawyer entrepreneur. In this regard, our vantage point is as both practitioner and consumer in the equation of access to capital and business growth. We know firsthand that there is dissonance between law, policy, and practice when it comes to the capital people of color need and can access to grow and sustain their businesses. The dissonance or lack of harmony and consistency of desired outcomes between law, policy, and practice shows up in a variety of ways in the minority business growth arena.

There are good laws, developed from well-intended policy framing, that in practice fail to achieve the intended minority business growth outcomes. SBA 7(a) lending addressed in this paper is an example of such discordance between law, policy, and practice. There are good policy frames that result in law changes that when implemented drive results that are the exact opposite of what the good policy frame intended. The effect of the Volker Exemption on community banks as the result of recent changes to the Dodd-Frank Wall Street Reform and Consumer Protection Act discussed below is such an example. And there is law that dictates actions that result in ineffective policy and practice because of the lack of definitions, standards, and monitoring mechanisms, some of which is seen in the SBA 8(a) set aside program and in some of the “procurement programs” discussed in Sections III and IV. In this construct we rely on the ordinary understanding of what is law and what is supporting policy, however, we define practice as how law and policy are applied and/or implemented, including the decision-making process guiding application and implementation. Practice as used here includes the subjective decision making that exists in the application and the implementation of law and policy.

We know firsthand that the dissonance can and does fall in any or all of the areas in a single transaction. And we know that without examination through a variety of eyes, the behavior will continue: more and more laws will be generated to address the disparity, with more policy implications, and more dissonance between law, policy, practice, and outcomes, continuing the deleterious cycle of eroding economic power, just like the set of laws and policies before it.

[. . .]

This Article presents an overview of an extensive set of laws, policies, and implementing regulations; that is, good laws that have been in place for sufficient time to assess impact. There is, however, ample evidence to conclude that the laws, policies, and implementing regulations have failed to eliminate disparity in business financing and the opportunity to scale economic growth for the vast majority of M/WBEs in this country. In closing, this Article is less about the laws, more about policy (with the assumption that policy makes law actionable), and most about practices. It looks at the practices that have flawed the implementation of otherwise good, not perfect, but good laws. Practice that is rooted in historical assumptions; practice that cannot be changed by law alone. What we attempt here is to shine a bright light on the incongruence so that solutions can be crafted that buffet against bad, disparate, and discriminatory practices--solutions that take out the cognitive dissonance between what the law says and what is actually done.

We recognize that this Article is more informative than dispositive. But, as we stated at the onset, it will take a variety of examining eyes to begin to address the disconnect between law, policy, practice, and desired outcomes to change the cycle of behavior illuminated here. Behavior that is so clearly stifling economic growth for M/WBEs.

Sandra M. Moore, Esq., is Managing Director and Chief Impact Officer at Advantage Capital.

Dorothy L. White-Coleman is the member/manager of White Coleman & Associates, LLC, which is located in downtown St. Louis, Missouri.

Become a Patreon!